1 Department of Economics, University of Kashmir, Srinagar, Jammu and Kashmir, India

2 Centre for Distance and Online Education, University of Kashmir, Srinagar, Jammu and Kashmir, India

This study investigates the determinants of foreign exchange reserves in India using quarterly data from 2000Q1 to 2020Q4. Employing a structured two-stage framework, the analysis first derives a long-run money demand function through the ARDL bound testing approach, from which a domestic money market disequilibrium term is generated. This term is then integrated into the short-run reserve demand function using an unrestricted error-correction model. The empirical findings reveal that the average propensity to import exerts a strong negative long-run effect on reserves (elasticity: –1.21), while foreign portfolio investment (elasticity: 0.51) and short-term external debt (elasticity: 0.55) have significant positive effects. In the short run, money market disequilibrium negatively influences reserves (coefficient: –1.02), with an error-correction adjustment speed of 11% per quarter. Reserve adequacy diagnostics further confirm that by 2020, India’s reserves covered 12 months of imports, exceeded short-term external debt by a factor of more than two and represented over 20% of broad money supply, far surpassing international adequacy thresholds. These results demonstrate that India’s reserve accumulation, though precautionary in nature, has generated a consistent surplus beyond conventional benchmarks. The study concludes that such surplus reserves can be strategically redeployed towards external debt reduction and high-return domestic investments, thereby optimising the balance between precautionary holdings and development financing. In doing so, the findings highlight important societal benefits, including enhanced macroeconomic stability, reduced fiscal costs and the creation of fiscal space for health, education and infrastructure, consistent with the objectives of sustainable growth. By integrating updated evidence with actionable policy recommendations, this article contributes to the discourse on dynamic reserve management in emerging economies.

Economic and business policy, financial economics, international management, policy

Aizenman, J., & Lee, J. (2007). International reserves: Precautionary versus mercantilist views, theory and evidence. Open Economies Review, 18(2), 191–214. https://doi.org/10.1007/s11079-007-9030-z

Aizenman, J., & Marion, N. (2003). The high demand for international reserves in the Far East: What is going on? Journal of the Japanese and International Economies, 17(3), 370–400. https://doi.org/10.1016/S0889-1583(03)00008-X

Bahmani-Oskooee, M., & Poorheydarian, M. (1990). The demand for money in open economies: The case of the United States. Economics Letters, 33(2), 185–191. https://doi.org/10.1016/0165-1765(90)90222-P

Bird, G., & Rajan, R. (2003). Too much of a good thing? The adequacy of international reserves in the aftermath of crises. World Economy, 26(6), 873–891. https://doi.org/10.1111/1467-9701.00552

Calvo, G. A. (1998). Capital flows and capital-market crises: The simple economics of sudden stops. Journal of Applied Economics, 1(1), 35–54.

Calvo, G. A., & Mendoza, E. G. (1996). Mexico’s balance-of-payments crisis: A chronicle of a death foretold. Journal of International Economics, 41(3, 4), 235–264.https://doi.org/10.1016/S0022-1996(96)01436-5

Chami, R., Cosimano, T., & Gapen, M. (2008). Beware of emigrants bearing gifts: Optimal fiscal and monetary policy in the presence of remittances. IMF Working Paper WP/08/29. International Monetary Fund. https://doi.org/10.5089/9781451868886.001

Cheung, Y. W., Qian, X., & Remolona, E.(2019). Hoarding of international reserves: It’s a neighbourly day in Asia. Pacific Economic Review, 24(2), 208–240. https://doi.org/10.1111/1468-0106.12297

Chakrabarty, K. C., & Bordoloi, S. (2013). An analysis of India’s foreign exchange reserves. RBI Bulletin, Reserve Bank of India, April 2013.

Chowdhury, M. N. M., Uddin, M. J., & Islam, M. S. (2014). An econometric analysis of the determinants of foreign exchange reserves in Bangladesh. Journal of World Economic Research, 3(6), 72–82. https://doi.org/10.11648/j.jwer.20140306.12

Dominguez, K. M., Hashimoto, Y., & Ito, T. (2012). International reserves and the global financial crisis. Journal of International Economics, 88(2), 388–406. https://doi.org/10.1016/j.jinteco.2012.03.003

Edwards, S. (1984). The demand for international reserves and monetary equilibrium; some evidence from developing countries. Princeton University, International Finance Section.

Ford, J. L., & Haung, G. (1994). The demand for international reserves in China: An ECM model with domestic monetary disequilibrium. Economica, 379–397. https://doi.org/ 10.2307/2554622

International Monetary Fund (IMF). (2013). World Economic Outlook: Transitions and tensions. International Monetary Fund. https://www.imf.org/en/Publications/WEO/Issues/2016/12/31/World-Economic-Outlook-October-2013-Transitions-and-Tensions-40804

International Monetary Fund (IMF). (2016). World Economic Outlook: Too slow for too long. International Monetary Fund. https://www.imf.org/en/Publications/WEO/Issues/2016/12/31/World-Economic-Outlook-April-2016-Too-Slow-for-Too-Long-43718

Jeanne, O. (2007). International reserves in emerging market countries: Too much of a good thing? Brookings Papers on Economic Activity, 1, 1–79.

Kashif, M., & Sridharan, P. (2020). Factors Affecting International Reserves: With Special Reference to Sri Lanka. Pondicherry Central University, School of Management.

Law, C. H., Soon, S. V., & Ehigiamusae, K. U. (2021). The nonlinear impact of institutional quality on international reserves: International evidence. Journal of International Commerce, Economics and Policy, 12(3), 2150014. https://doi.org/10.1142/S179 3993321500149

Mishra, R. K., & Sharma, C. (2011). India’s demand for international reserve and monetary disequilibrium: Reserve adequacy under floating regime. Journal of Policy Modelling, 33(6), 901–919. https://doi.org/10.1016/j.jpolmod.2011.03.005

Nayak, S., & Baig, M.A. (2019). International reserves and domestic money market disequilibrium: Empirics for India and China. International Journal of Emerging Markets. https://doi.org/10.1108/IJOEM-10-2018-0536

Ocampo, J. A. (2013). The macroeconomics of the resource curse. In R. Arezki, T. Gylfason, & A. Sy (Eds.), Beyond the resource curse (pp. 11–39). International Monetary Fund.

Pontines, V., & Rajan, R. S. (2011). Foreign exchange market intervention and reserve accumulation in emerging Asia: Is there evidence of fear of appreciation? Economics Letters, 111(3), 252–255. https://doi.org/10.1016/j.econlet.2011.01.022

Prabheesh, K. P., Malathy, D., & Madhumathi, R. (2007). Demand for foreign exchange reserves in India: A co-integration approach. South Asian Journal of Management, 14(2), 36–46.

Ramachandran, M. (2004). The optimal level of international reserves: Evidence for India. Economics Letters, 83(3), 365–370. https://doi.org/10.1016/j.econlet.2003.11.015

Rodrik, D., & Velasco, A. (1999). Short-term capital flows. [Working Paper No. 7364]. National Bureau of Economic Research. https://doi.org/10.3386/w7364

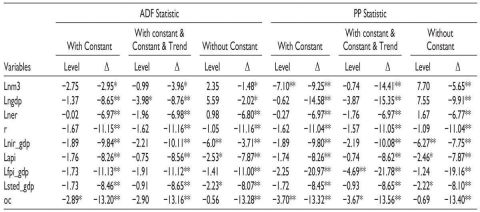

Appendix A

Table A1. Results of Unit Root Test.

Notes: .png/image(40)__20x17.png) refers to first difference.

refers to first difference.

* and **: Statistically significant at 1% and 5%, respectively.

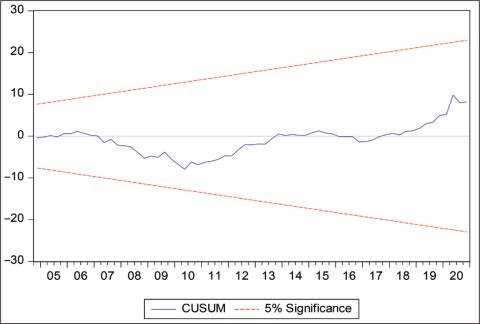

Appendix B. Stability Diagnostics

Figure B1. CUSUM Test for Long-run Money Demand Function.

Note: The CUSUM statistic remains within the 5% significance band, confirming stability of the estimated coefficients.

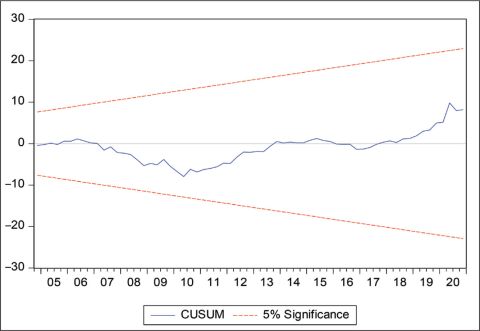

Figure B2. CUSUM Test for Long-run Reserve Demand Function.

Note: The CUSUM statistic stays well within the critical bounds, indicating stability of the reserve demand function estimates.

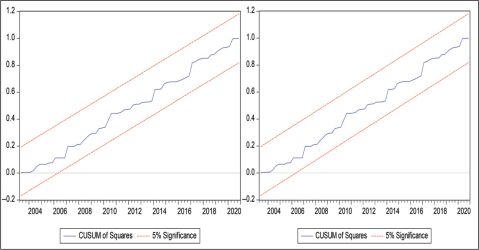

Figure B3. CUSUM of Squares Test for Long-run Money Demand.

Note: The CUSUMQ statistic lies within the 5% significance bands throughout the sample period, suggesting parameter constancy and absence of structural breaks.

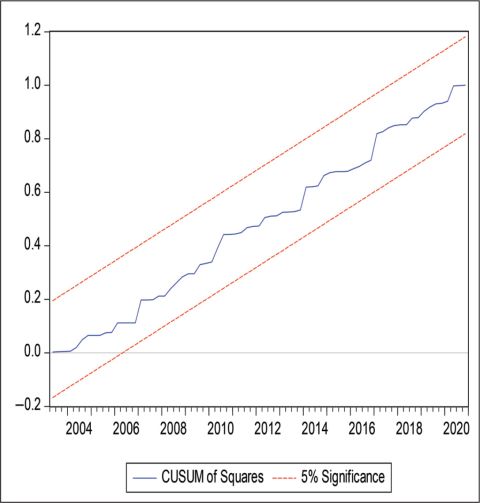

Figure B4. CUSUM of Squares Test for Reserve Demand Function.

Note: The CUSUMQ statistic lies within the 5% significance bands throughout the sample period, suggesting parameter constancy and absence of structural breaks.